A Forex broker rating can help you select the ideal broker for your trading needs and preferences. When researching brokers, look for those offering competitive spreads and fees as well as any hidden charges for deposits and withdrawals. Obtain the Best information about forex robot.

Considerations should also include the breadth of assets available for trading, trading platforms, and customer support available from your broker, as well as whether it is regulated by a reputable body.

Platforms

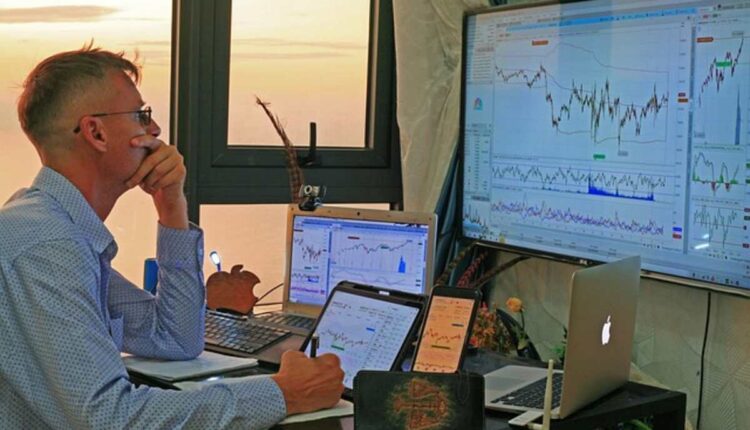

Forex traders have an array of trading platforms available to them. Some platforms provide traders with tools for analysis, such as various graphical types of price displays and technical indicators, news feeds and economic calendars, and tools for managing trades. Other features may include news feeds and economic calendars, as well as tools for managing trades. Some platforms even allow users to develop automated strategies using built-in scripting languages; these may require extensive knowledge. When choosing a platform, please take into consideration its ease of use and whether it aligns with your trading style preferences.

When selecting the appropriate broker, it is crucial that they offer an extensive range of trading instruments and are regulated by reliable regulatory bodies. Some top brokers include AvaTrade, Pepperstone, and XM Group, with the latter having many popular currency pairs as well as being overseen by various reputable authorities such as the Australia Securities and Investment Commission (ASIC), Financial Conduct Authority (FCA) in the UK, CySEC in Cyprus, etc.

XM Group stands out as an innovator and provider of innovative trading platforms that ensure an optimal experience for traders of all levels of expertise. These include MetaTrader 4 and 5 platforms as well as cTrader and TradingView, which feature advanced charting features and technical analysis tools; in addition to these user-friendly platforms with convenient search features, various order types, and sophisticated box orders.

Trading conditions

Forex trading is a continuous process, and brokers should offer around-the-clock customer support via live chat, email, and phone. Some even provide online academies or collaborations with professional instructors as a sign that they care for their clients and want them to achieve success on the market.

A good forex broker will offer competitive trading conditions and precise information regarding their fees, making assessing trading costs easy by reviewing the broker’s website or using an asset trade cost calculator they provide.

One critical consideration when choosing a forex broker is its regulation by an authoritative body. Regulated brokers must separate client funds from working capital and adhere to stringent financial standards while offering deposit protection and formal dispute resolution processes.

Experience and track record are two essential components of a forex broker’s reputation. A longstanding broker will have built up credibility, reliability, and trust from traders and investors over time—it is always preferable to choose an experienced one.

Leverage

Leverage is a tool used by forex traders to increase their buying power and potential profits from trades. It works by borrowing funds from brokers to open larger positions than one’s own capital can allow, although it increases risk. Therefore, it’s vital that traders have an effective risk management plan and an understanding of how leverage works in order to leverage appropriately.

Regulators and brokers differ when it comes to the maximum leverage allowed on forex pairs, account types, and other factors. When selecting your broker, they must offer maximum leverage that matches your personal risk tolerance as well as margin call and stop-out levels specific to your account.

Traders must also ensure their broker offers robust site security and compensation schemes to protect them if their forex broker becomes insolvent; brokers regulated by CySEC are eligible to participate in the Investor Compensation Fund (ICF), providing protection of up to 20,000 euros for traders in this instance.

The top forex brokers provide user-friendly trading platforms, fast execution speeds, a diverse selection of instruments to trade, educational resources, and customer support; in addition, they offer various account types to meet individual trading needs.

Customer support

Customer support should be one of your primary considerations when selecting a forex broker. A dependable broker should offer various communication channels—live chat, and phone support is excellent examples—to address traders’ inquiries and concerns quickly and efficiently. In addition, the broker should offer educational resources to improve trading skills. In such a fast-paced market as forex trading, having reliable support teams that respond quickly can prevent costly errors.

Traders should always seek out brokers with exceptional customer service credentials. This will be key in assessing how effective their services are and whether or not they can fulfill their promises. A top forex broker provides clients with exceptional trading conditions while creating fair and competitive trading environments.

Customer support teams that excel will respond to queries quickly, no matter the time or day. They will provide traders with timely help when needed, relieving stress levels while making trading simpler. They should also be available to answer any inquiries you have regarding their services.

Reliability and reputation are ultimately the two critical criteria to consider when selecting a forex broker. Reliability refers to how trustworthy and dependable the broker is, while reputation refers to how prominently known the broker is in the industry.