It’s only natural to want to safeguard your most valuable possession by purchasing homeowner’s insurance. Even so, there’s no point in paying more for homeowner’s insurance than is strictly necessary. Fortunately, there are several steps you can take right away — some elementary, some more difficult — that will immediately cut the cost of your homeowner’s insurance.

First, let’s briefly examine how much insurance you need. You should have insurance that pays for the cost of rebuilding your home from the ground up and replacing everything inside it. The land your house is on is not something you need to insure against.

Make sure your credit history is clean. Did you know that the better your credit, the less you’ll pay for your monthly house insurance?

Take precautions to ensure no one will be injured on your premises. Fix or replace any sagging or broken porch or deck boards, level any uneven sidewalks, and fill in any holes you find.

Secure your home from intruders next. Put in motion detector floodlights and prune back vegetation around windows. Check the deadbolts and locks on all external doors and windows, and replace any broken ones.

Smoke and fire alarms are necessary, so ensure you have the correct number installed and update the batteries twice a year.

Get a fire extinguisher designed for kitchen use and install it in a visible spot.

You can save 20% or more on your monthly homeowner’s insurance premium by installing a home security system monitored remotely 24 hours a day, seven days a week. However, it is important to discuss the possibility of a premium discount with your agent before purchasing any such system.

Talk to your tax preparer about deducting the cost of such a system if you run a business out of your house. You could reduce your tax liability and save money on your homeowner’s insurance by installing a security system in your home.

Is there anyone in your home who is 55 or older and has retired? If so, let your agent know because doing so could further reduce your monthly premiums.

Most homeowner insurance claims include water damage from leaky pipes or appliances that weren’t properly connected. Ask your real estate agent how much money you can save by upgrading your plumbing and electrical systems if your home is older than ten years. The math can work out to excellent monthly savings.

Is it possible for you to raise your deductible? Homeowners’ insurance premiums can be lowered very immediately by raising the deductible, but only if the new, higher amount is within your financial means.

It’s time to put this article’s advice to use and head to the web. Get at least three quotes for homeowners insurance by filling out online forms, but be sure to use consistent information across all of them. You may rest assured that you are constantly comparing apples to apples by using this method.

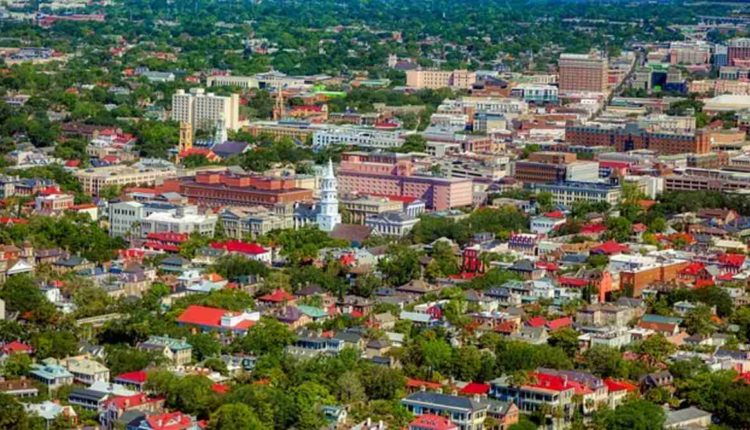

Find out which insurance providers you have the most faith in being operational 30 years from now, and then pick the one offering the most affordable policy. So long! You’ve completed all the steps for comparing affordable South Carolina homeowner’s insurance and have saved a ton of money. I applaud your effort.

Where to go for affordable house insurance, as suggested by me

South Carolina Homeowners Insurance Quotes [http://www.ezquoteguide.com/home/] – Get the Best Deals!

Affordable Home Insurance

Read also: https://codesmech.com/category/insurance/